In today’s fast-paced financial industry, staying compliant with ever-evolving regulations is not just a necessity—it’s a competitive advantage. Financial institutions face increasing pressure to ensure their teams are well-trained and up-to-date with compliance requirements. This is where a Financial Compliance LMS (Learning Management System) comes into play. A robust LMS platform for financial compliance can streamline training, reduce risks, and ensure your organization meets regulatory standards efficiently.

But with so many options available, how do you choose the right Compliance LMS for you? In this blog, we’ll explore the key features to look for in a Financial LMS to ensure it meets your organization’s needs and drives long-term success.

Why a Financial Compliance LMS is Essential

Before diving into the features, it’s important to understand why a specialized LMS platform for financial compliance is critical. Financial regulations are complex and constantly changing. Non-compliance can result in hefty fines, reputational damage, and even legal consequences. A Financial Compliance LMS helps organizations:

- Deliver consistent and up-to-date compliance training.

- Track employee progress and certification.

- Reduce the risk of non-compliance through automated reporting.

- Save time and resources by centralizing training efforts.

Now, let’s explore the must-have features that make a Compliance LMS truly effective.

1. Regulatory Content Updates and Customization

One of the most critical features of a Financial Compliance LMS is its ability to provide up-to-date regulatory content. Financial regulations change frequently, and your LMS must keep pace. Look for a platform that offers:

- Automated Content Updates: Ensure the LMS integrates with regulatory bodies to provide real-time updates.

- Customizable Training Modules: Tailor content to reflect your organization’s specific policies and procedures.

- Local and Global Compliance Support: If your organization operates internationally, the LMS should support multiple regulatory frameworks.

A Compliance LMS with these capabilities ensures your team is always trained on the latest requirements, reducing the risk of non-compliance.

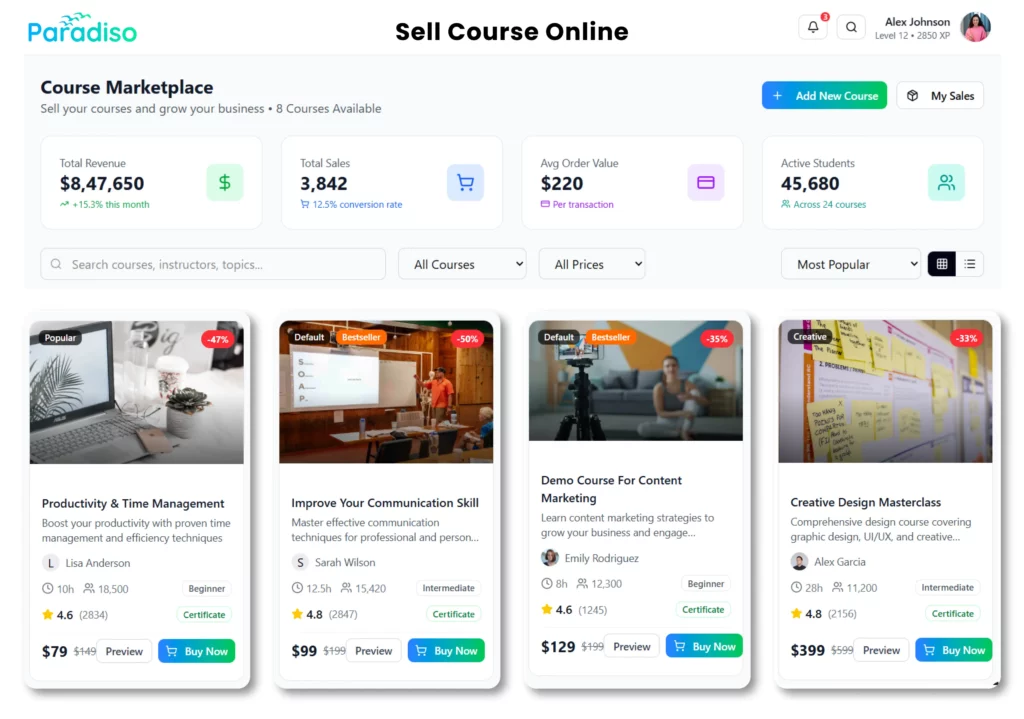

2. Advanced Reporting and Analytics

Compliance training isn’t just about delivering content—it’s about proving that your team has completed and understood the training. A robust Financial LMS should offer advanced reporting and analytics features, such as:

- Real-Time Tracking: Monitor employee progress and completion rates in real time.

- Audit-Ready Reports: Generate detailed reports for internal audits or regulatory inspections.

- Customizable Dashboards: Visualize key metrics like compliance rates, certification status, and training gaps.

These features not only simplify compliance management but also provide actionable insights to improve training effectiveness.

3. User-Friendly Interface and Accessibility

A Financial Compliance LMS is only as good as its adoption rate. If the platform is difficult to use, employees may struggle to complete their training, leading to compliance gaps. Key usability features to look for include:

- Intuitive Design: A clean, easy-to-navigate interface that minimizes the learning curve.

- Mobile Compatibility: Ensure the LMS is accessible on multiple devices, including smartphones and tablets.

- Multilingual Support: For global organizations, the platform should support multiple languages to cater to diverse teams.

A user-friendly LMS platform for financial compliance ensures higher engagement and better training outcomes.

4. Integration with Existing Systems

Your Financial Compliance LMS shouldn’t operate in isolation. It should seamlessly integrate with your existing HR, CRM, or ERP systems to streamline data flow and reduce administrative burdens. Key integration capabilities include:

- Single Sign-On (SSO): Allow employees to access the LMS using their existing credentials.

- API Support: Enable data exchange between the LMS and other enterprise systems.

- Third-Party Tool Integration: Integrate with tools like Zoom or Microsoft Teams for virtual training sessions.

Integration ensures a cohesive ecosystem, making compliance training more efficient and less disruptive to daily operations.

5. Gamification and Engagement Tools

Let’s face it—compliance training isn’t always the most exciting topic. However, a Financial LMS with gamification features can make learning more engaging and effective. Look for features like:

- Badges and Certificates: Reward employees for completing courses or achieving high scores.

- Leaderboards: Foster healthy competition by showcasing top performers.

- Interactive Content: Use quizzes, videos, and simulations to make training more interactive.

Gamification not only boosts engagement but also improves knowledge retention, ensuring your team is better prepared to meet compliance requirements.

6. Scalability and Flexibility

As your organization grows, so do your compliance training needs. A Financial Compliance LMS must be scalable and flexible enough to accommodate changing requirements. Key considerations include:

- Unlimited Users and Courses: Ensure the platform can handle a growing number of employees and training modules.

- Customizable Workflows: Adapt the LMS to match your organization’s unique processes.

- Cloud-Based Infrastructure: Opt for a cloud-based solution that offers scalability without the need for additional hardware.

Scalability ensures your Compliance LMS remains a valuable asset as your organization evolves.

7. Security and Data Privacy

Given the sensitive nature of financial data, security is a top priority when choosing a Financial Compliance LMS. Ensure the platform offers:

- Data Encryption: Protect sensitive information with advanced encryption protocols.

- Role-Based Access Control: Restrict access to sensitive data based on user roles.

- Compliance with Data Privacy Laws: Ensure the LMS adheres to regulations like GDPR or CCPA.

A secure LMS platform for financial compliance safeguards your data and builds trust with employees and regulators alike.

8. Customer Support and Training Resources

Even the most user-friendly Financial LMS may require occasional support. Look for a provider that offers:

- 24/7 Customer Support: Ensure help is available whenever you need it.

- Dedicated Account Managers: Receive personalized assistance for your organization’s needs.

- Comprehensive Training Resources: Access tutorials, webinars, and documentation to maximize the platform’s potential.

Reliable support ensures a smooth implementation and ongoing success with your Compliance LMS.

Conclusion: Choosing the Right Financial Compliance LMS

Investing in a Financial Compliance LMS is a strategic decision that can significantly impact your organization’s compliance posture and overall success. By prioritizing features like regulatory content updates, advanced reporting, user-friendly design, and robust security, you can ensure your chosen platform meets your needs and delivers long-term value.

Remember, the right LMS platform for financial compliance isn’t just a tool—it’s a partner in your journey toward regulatory excellence. Take the time to evaluate your options, and choose a solution that aligns with your organization’s goals and challenges.

Ready to transform your compliance training? Explore the best Financial Compliance LMS solutions today and empower your team to stay ahead of the curve.